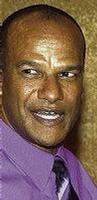

Left: Bill Clarke, president of BNS Jamaica. Right: Peter Bunting, chairman of DB& - G File photos

The Jamaica Stock Exchange, in a preemptive move, suspended trading in two financial sector stocks Thursday fearing the market would have reacted disproportionately to talks of an acquisition.

"Trading will resume in these shares on Friday, September 15," the JSE said.

The move by the JSE followed an advisory Wednesday night by Bank of Nova Scotia Jamaica attempting to downplay reports that it was in talks to buy investment bank Dehring Bunting and Golding Limited.

BNS confirmed the talks but said they were preliminary, and that the discussions centred on a possible acquisition of a "controlling" stake in DB&G.

"There is no assurance that a transaction will result from these discussions and no further comment will be forthcoming," the bank said in a three paragraph press statement.

That advisory was mandated by the JSE, after heavy trading of the stocks Wednesday, when the Jamaica Observer floated in a news report, that the William Clarke-run commercial bank was buying the DB&G, principally owned by Peter Bunting who holds 39.9 million of more than 303 million issued shares.

Both stocks traded higher - BNS was up $1.05 to $21.00 and DB&G climbed by $2.40 to $18.50.

On Wednesday, BNS dismissed report of a pending deal as "market rumour" and said it commented only because both the JSE and the Trinidad & Tobago Stock Exchange had requested it.

The commercial bank was not the only party said to be interested in the investment bank.

Last year, there were rumours that a local rival financial house was to have bought DB&G and later in the year there were also whispers that a Trinidad firm was interested.

BNS cautioned in statements cautioned that the success of negotiations was "not guaranteed" and that any deal would be subject to "numerous conditions" including regulatory approvals.

business@glenaerjm.com